What Are Tariffs?

Tariffs are taxes imposed on goods imported from other countries. Typically calculated as a percentage of the product’s value, tariffs make imported goods more expensive. As a result, domestic products become relatively cheaper, reducing competition, and supporting local production. This ultimately means higher costs for consumers.

What Is Trump’s Rationale for the Tariffs?

President Trump has justified the imposition of tariffs on various grounds. One key reason is his stated goal of curbing illegal immigration and the influx of drugs—especially fentanyl—into the U.S. markets. However, a major aspect of his trade policy, highlighted throughout his campaign, has been reducing the U.S. trade deficit. By imposing tariffs, he aims to lower imports and boost domestic production, which would reduce reliance on foreign goods and strengthen the U.S. economy.

How Much Is Trade Affected?

On February 1st, 2025, President Trump signed an executive order that imposed tariffs on the U.S.’s three largest trading partners—China, Canada, and Mexico.

For Canada, the impact is significant:

- Most exports will be hit with a 25% tariff.

- Energy exports, notably oil and gas, will face a 10% tariff.

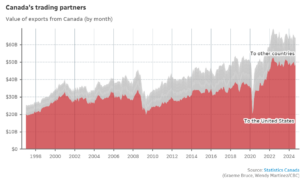

This move affects the U.S.-Canada trade relationship, as the U.S. is one of Canada’s largest trading partners, with billions of dollars worth of goods exchanged annually.

Canada’s trading partners. Value of exports from Canada (by month)

What is the Potential Impact on Canada?

Canada’s economy is already in a relatively fragile state, and the new tariffs could exacerbate this weakness. The imposition of these tariffs could create a negative shock to economic growth, potentially pushing the country into a recession. One of the immediate consequences could be a rise in unemployment, as industries struggle to absorb the higher costs and disruptions caused by the tariffs.

Supply chains will likely face significant disruptions, as the cost of importing materials and goods increases. This, in turn, could lead to higher prices across a range of products, eroding consumer purchasing power and potentially dampening overall demand.

Additionally, the Canadian dollar could continue to depreciate in the wake of these tariffs, making foreign goods even more expensive for Canadian consumers and businesses.

What was Canada’s Response?

In retaliation, Prime Minister Justin Trudeau announced that Canada would impose 25% tariffs on U.S. imports worth approximately C$155 billion. Alongside these measures, he has urged Canadians to support domestic businesses by choosing Canadian-made products, aiming to reduce reliance on U.S. goods and mitigate the economic impact.

What’s Next?

Global financial markets initially reacted negatively to the announcement of tariffs. However, they began to recover when reports surfaced that tariffs on Canadian and Mexican goods would be postponed for another 30 days, providing more time for negotiations.

What Can Our Subscribers Do?

Given the ongoing uncertainty, we expect market volatility to remain elevated in the short term. In such times, it’s crucial to maintain a long-term investment perspective and resist the temptation to make drastic decisions based on short-term market fluctuations. We believe that a well-diversified portfolio, a focus on managing risk, and professional money management are key to protecting the financial well-being of our subscribers.

We Want to Hear From You

Embark has created a survey to better understand our subscribers’ thoughts and concerns regarding the tariffs and their potential impact. Please take a moment to share your opinions with us. Your feedback is important to us as we navigate these uncertain times together.

The information provided on this platform is for informational purposes only and should not be considered financial, investment, legal, or tax advice. It does not constitute an offer, solicitation, or recommendation to buy or sell any investment product or security. Past performance is not indicative of future results. Always consult with a qualified financial advisor or professional before making any investment decisions. We do not guarantee the accuracy, completeness, or timeliness of the information provided, and we are not responsible for any losses or damages resulting from reliance on this content.

Head of Investments

Yelena Stepanyan is the Head of Investments at Embark. A lover of all things related to the financial markets, she is the past Chair of the CFA Society Toronto's Institutional Asset Management Committee, where she currently serves as a Senior Advisor.