Add RESPs to your corporate benefits.

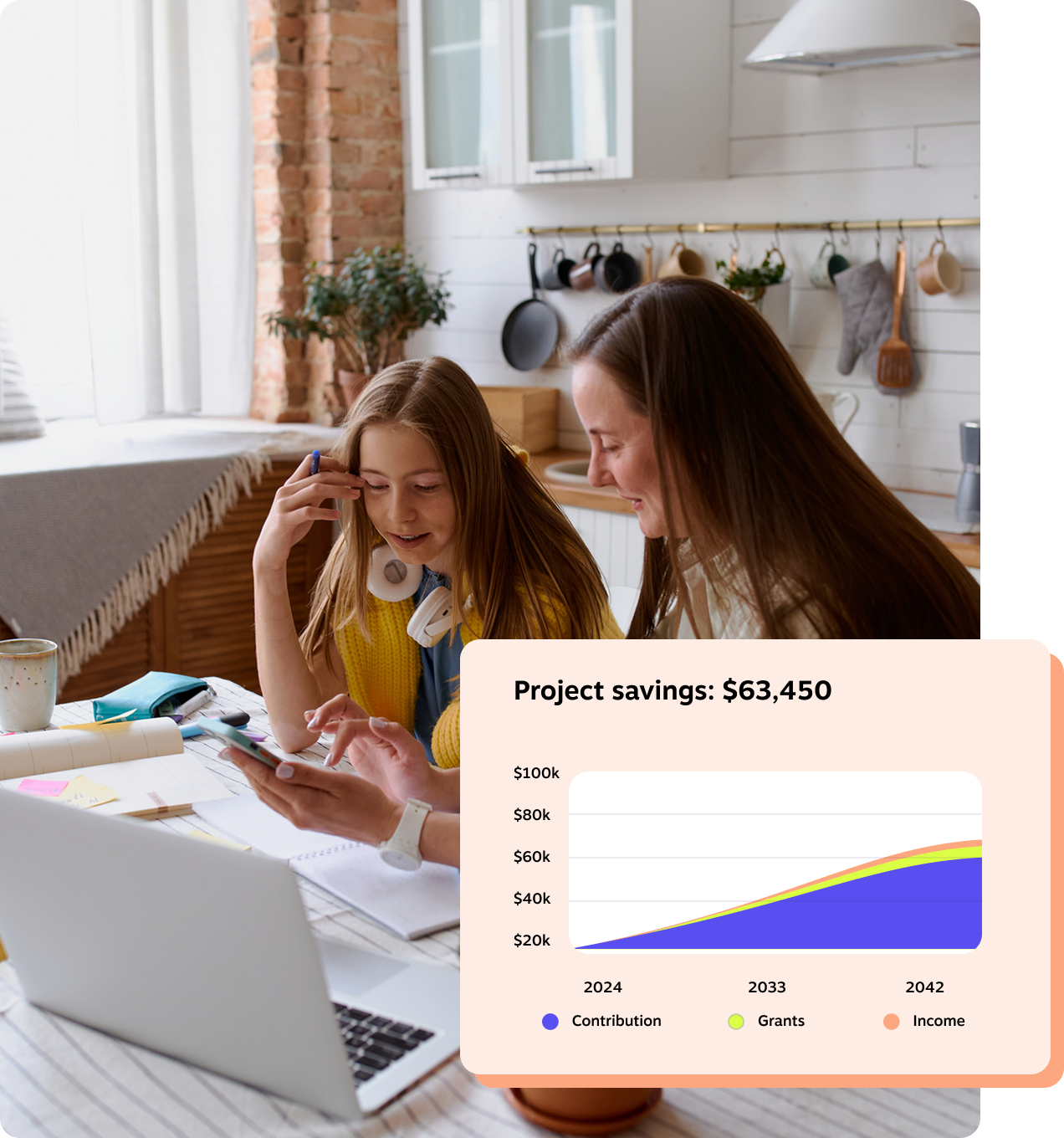

Offering RESPs through Embark helps employees save for their kids’ education and shows you’re invested in their future.

How We Can Support Your Business

We offer many programs to suit your needs, objective and vision. Our programs can help you bolster recruitment and retention, adding industry-leading tools to your organization’s offering.

$6.4 billion

In savings managed by Embark

1.2 million+

Families and supporters who enjoy the benefits of being part of Embark.

Trusted Partners

Help manage your plan