How to withdraw RESP from your Embark plan

Accessing Your Savings

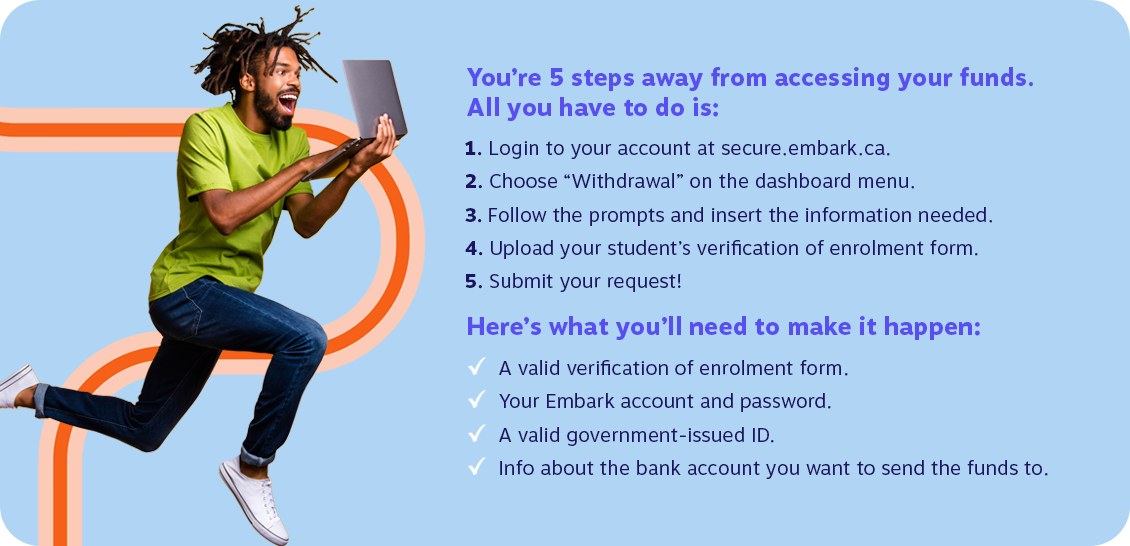

How To Withdraw RESP

- 1. Login to your secure online account.

- 2. Select withdrawal from the menu (if prompted, choose the type of withdrawal you are looking to make).

- 3. Enter the required information.

- 4. Upload your student’s Verification of Enrollment (you can get one from the student’s school’s website or registrar’s office).

- 5. Submit your request!

Withdrawal Checklist

- 1. Verification of Enrollment.

- 2. Your Embark secure account login.

- 3. Government issued ID (subscriber and beneficiary’s SIN number).

- 4. Online banking credentials to link accounts.

How to Activate Your Embark Student Plan

- 1. Ensure you have a government-issued photo ID and your social insurance number.

- 2. Enter your email address and password.

- 3. Verify your account and identity with your SIN and government ID.

- 4. Update your investment risk profile.

Ready to withdraw?

Sign in to your account to begin the process. If you have a Flex First or Family Single Student Plan you will first need to activate your new Embark account to withdraw your funds.

Withdrawal Hub

How To Withdraw RESP

When it comes to saving for education, being able to access your funds effortlessly is key. That’s why our hassle-free RESP withdrawal process is designed to make life easier for students and their families. Here is everything you need to know about how to complete the process online.

When to Withdraw RESP

As soon as your child has enrolled in their program of choice, and you’ve obtained a Verification of Enrolment (VOE) letter you are eligible to begin withdrawals from your RESP.

The next step to accessing your education savings is deciding the kind of payment you want to receive. The standard Education Assistance Payment (EAP) will give a beneficiary up to $8,000 if enrolled in a full-time program, or $4,000 for part-time, within the first 13 weeks of school.

After the first 13-weeks, full-time students can withdraw as much from their grants and income as they’d please, unless the beneficiary takes a break from their studies and does not re-enroll in a qualifying educational program for 12 months. If that happens, the original limit is reinstated.

Part-time students can only withdraw $4,000 in EAPs for every 13-week period of enrolment.

What You Need to Withdraw RESP

Depending on the type of withdrawal you are making, different documentation may be required to confirm your eligibility. The most important document you’ll need to submit a withdrawal request on your secure Embark account is a Verification of Enrolment. Your request cannot be moved forward until that document is uploaded and submitted.

Embark Plans are all about being user-friendly. Forget about dealing with piles of paperwork – Embark’s digital platform makes the entire withdrawal process a breeze. In just five minutes or less, you can submit all your requirements online, without ever having to print, sign, or mail documents.

You can get your funds quickly and easily online.

If you do not plan to withdraw for educational purposes, or your child will not be going to school, (and will instead need to make a withdrawal in the form of an AIP or a NPSE), reach out to an Education Savings Specialist to understand your options and the process.

RESP Withdrawal Rules

Depending on the type of withdrawal you wish to make, there are different requirements for eligibility. Educational Assistance Payments (EAPs) and Post-Secondary Education Withdrawals (PSEs) can only be made to finance the beneficiary’s education expenses while attending a qualified post-secondary institution (universities, colleges, trade schools, and other eligible educational programs).

These types of withdrawals can cover various costs, including tuition fees, textbooks, supplies, transportation, and living expenses while attending school on a full-time or part-time basis.

Withdrawals made that are not intended to fund post-secondary education can be made as either Accumulated Income Payments (AIPs) or Non-Post-Secondary Education withdrawals (NPSEs). You can consider withdrawing an AIPs if your child/ the plan beneficiary will not attend post-secondary ever. NPSEs require a unique set of circumstances. They are a type of withdrawal that is made before your child enrolls in post-secondary and will result in awarded grant money being returned.

If you intend on withdrawing for non-education purposes speak to an Education Savings Specialist to understand the process and associated penalties.

Types of RESP Withdrawals Review

As stated above RESP withdrawals typically fall into two categories: Educational Assistance Payments (EAPs) and Post-Secondary Education Payments (PSEs). EAPs consist of the government grants and investment earnings accumulated in the RESP, while PSEs represent the contributions made by the subscriber (the person who opened the RESP).

| Type | What It Is | When To Use |

|---|---|---|

Educational Assistance Payment (EAP) | A withdrawal from your RESP meant to help pay for post-secondary education expenses like tuition, books and transportation. It’s made up of your accumulated grants, investment income and grant income, not your contributions. (You’re only allowed to withdraw up to $8,000 in the first 13 weeks of studying in a full-time program and $4,000 during the first 13 weeks of a part-time program) | Withdraw first. |

Post-Secondary Education (PSE) Withdrawal | These are your contributions (less any applicable fees), which can be withdrawn tax-free when your child enrolls into a qualifying post-secondary education or training program. | Withdrawal after EAP has been exhausted. |

Accumulated Income Payment (AIP) | Is used when your child is not currently enrolled in a post-secondary program. This form of withdrawal should only be considered if your child does not plan on pursuing a post-secondary education before the end of their RESP’s 35-year lifetime. | As a last option if your child is not going to post-secondary school ever. |

Non-Post-Secondary Education Withdrawal (NPSE)

If you choose to withdraw your contributions before your child enrolls in post-secondary school, the government will reclaim any grant money they contributed to your RESP as a result of that money being withdrawn. If you withdraw everything, they’ll take all your grants back and your RESP may be closed.

Additional Considerations for Accumlated Income Payments

You can only receive an AIP as a Canadian resident if:

- You’ve held your RESP for at least 10 years

- Your child is at least 21 years old

- Your child is not eligible for an Educational Assistance Payment (EAP)

Additional circumstances that may be required:

- Your plan has existed for 35 years

- All of the beneficiaries are deceased

Common RESP Withdrawal Questions

Smart RESP Withdrawing

When it comes to withdrawing funds from your RESP, there’s a right way and a wrong way to do it. These withdrawal tips can often save you and your child a lot of money:

- Withdraw EAPs first, especially in your first few years of school.

- Don’t withdraw contributions before enrolment.

- When withdrawing for non-educational purposes, move RESP income to another child’s RESP or your RRSP.

Be sure to take into consideration the length of your child’s program and budget the amount of money that can be withdrawn overtime to ensure they will have enough funding based on your goals or for the full duration of their schooling. This could include continued education like a masters, PhD, medical residency, or clinical program. The best way to do this is by dividing your savings equally or proportionately to the financial needs of each academic season.

Pro Tip:

Don’t prolong the withdrawing of your savings! If a beneficiary does not withdraw their funding within 6 months of finishing post-secondary, they will loose access to their grant money and income earned must be taken by the subscriber as an AIP, which will be taxed.

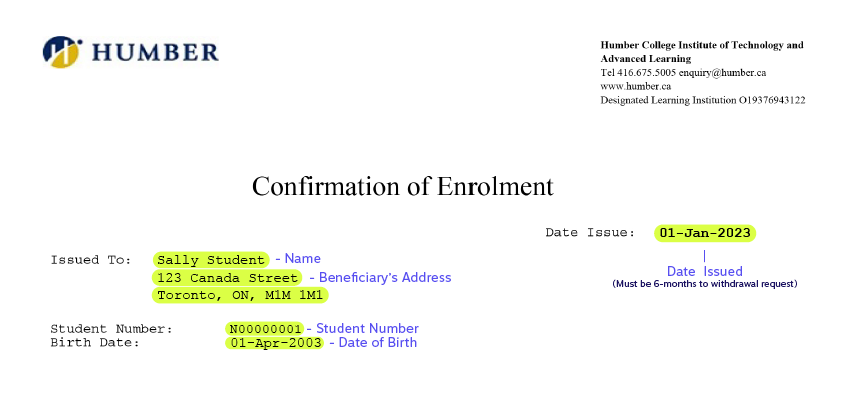

What is a VOE?

A Verification of Enrolment form, commonly known as a VOE form, is an official document provided by educational institutions to confirm a student’s enrolment status. This form serves as proof that a student is currently enrolled in a particular program at a trade school, college, or university. In the case of a Registered Educations Savings Plan (RESP), VOEs are used to confirm a beneficiary’s enrolment so they can access their education savings. For more information on VOEs please read our full article here.

How to Get Your Child’s VOE

Getting a VOE form your post-secondary institution typically involves the following steps:

- Contact your educational institution: Start by reaching out to the registrar’s office or the student services department at your educational institution. They will provide information on how to request a Verification of Enrolment form and any associated fees, if applicable.

- Provide required information: You will likely need to provide specific information to request a VOE form, such as your full name, student ID number, date of birth, and the purpose for which you need the form.

- Choose delivery method: Institutions may offer various delivery methods for the Verification of Enrolment form, including in-person pickup, mail delivery, or electronic delivery via email or secure online portal. Most schools/programs will provide easy access to view and print the VOE through your personalized student profile or center.

- Submit request and payment (if applicable): Follow the instructions provided by your educational institution to submit your request for a VOE form. Some institutions may require a processing fee for issuing the form, so be prepared to make a one-time payment if necessary.

- Receive and review the form: Once your request is processed, you will receive the Verification of Enrolment form. Review the document carefully to ensure that all information is accurate and complete.

- Use the form as needed: Present the Verification of Enrolment form to the relevant parties. If you are submitting the VOE to your RESP provider, review their submission process. For information on how to upload your VOE to your Embark Student Plan or Embark Select Conservative Plan click here.

Example:

What an RESP Pays For

What specifically can your RESP money be used for? This is something we love talking about because there are so many different ways that your savings can be used. Withdrawals from your RESP can help cover the following:

There are a lot of different expenses that may come up as your child pursues post-secondary. Even if they qualify for OSAP, there will still be expenses that you can use your RESP funds for.

To appropriately budget and save for your child’s education, we recommend checking out the expenses breakdown in your Embark secure account. This can help you understand what portion of your savings can be earmarked for tuition versus living expenses and everyday costs.