Give your RESP a boost with a 2% bonus!

Limited time offer! Transfer your RESP to Embark and get a 2% bonus*. Transfer your RESP now.

See why Embark is better

At Embark, education savings and planning is all we do. Our registered education savings plans help you:

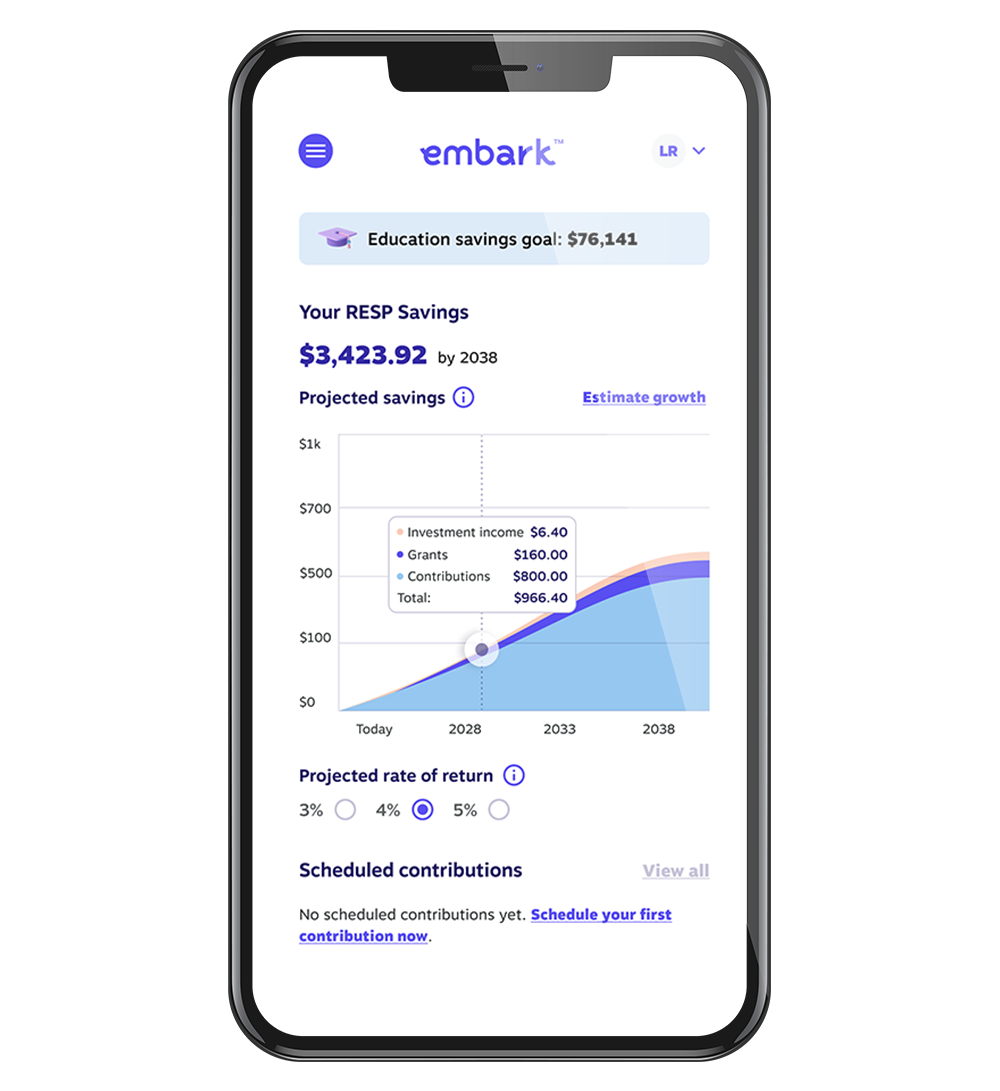

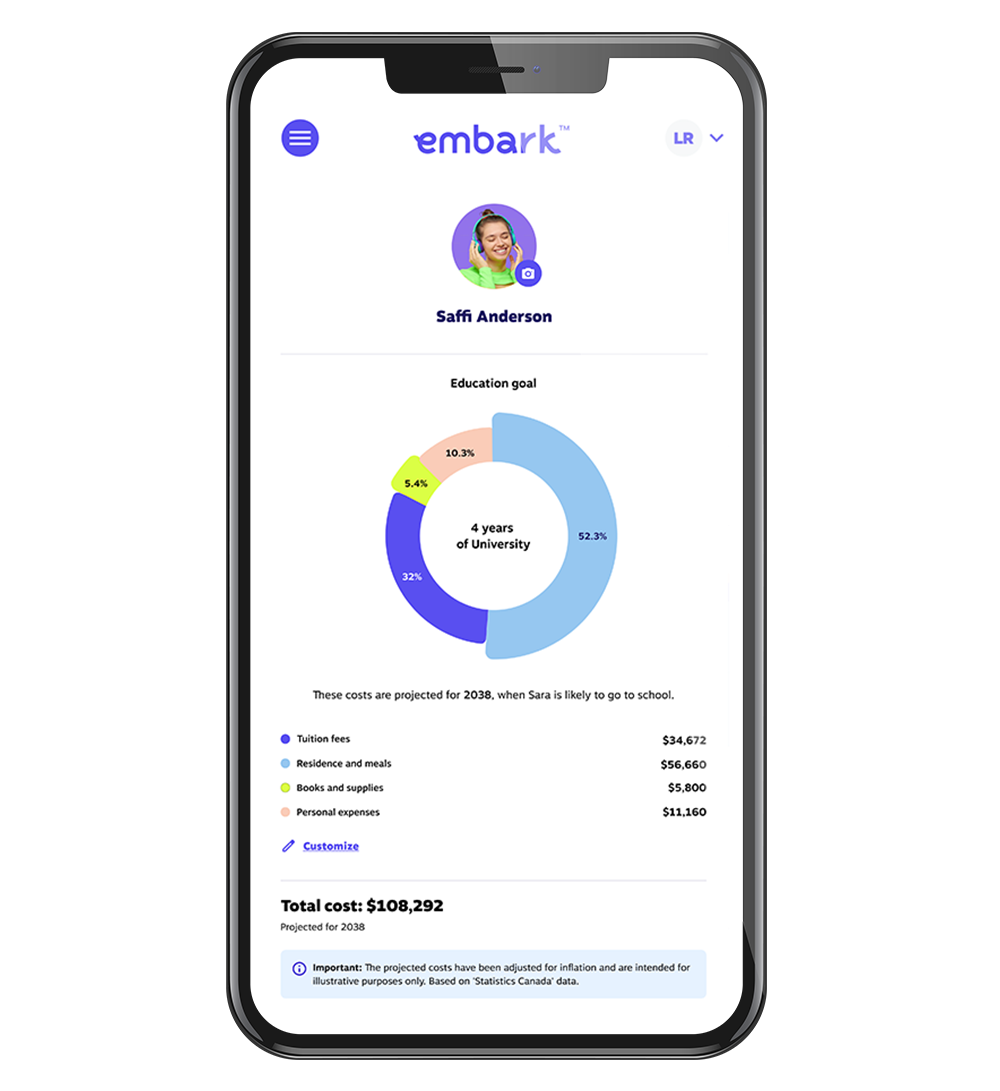

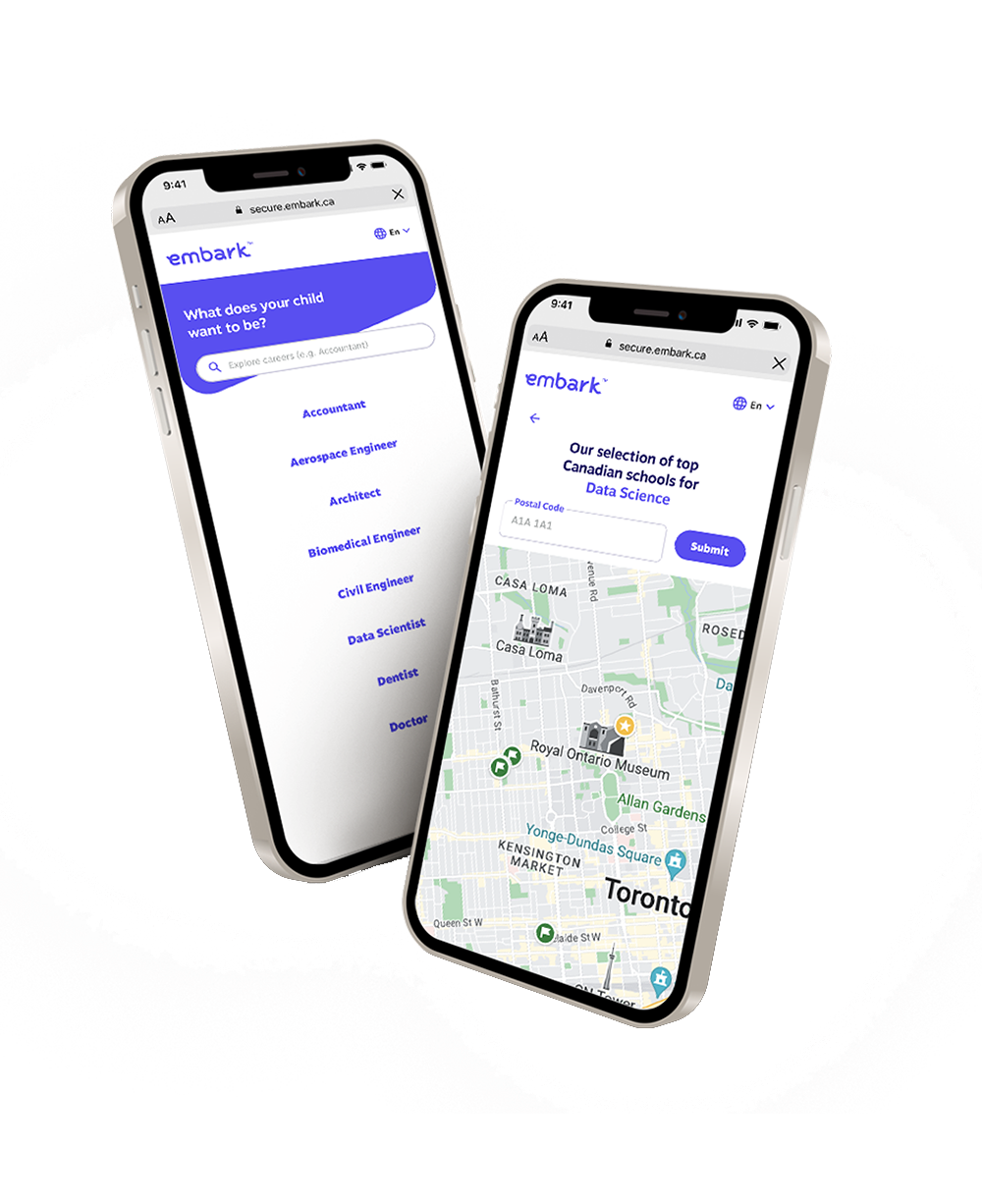

- Forecast how much their education costs and how much you’ll need based on your goals.

- Invest in a plan that automatically adjusts to your child’s age and needs. We’ll take care of everything for you.

- Save as much or as little as you want, whenever you want.

- Easily request a withdrawal online in minutes.

| Embark | Big 5 Banks1 | |

|---|---|---|

| Time to open | 8 minutes | 1 hour2 |

| Minimum investment | $0 | More than $4003 |

| Investment fees | 1.65% | 2.02%4 |

| Glide path investment | ✓ | ✗ |

| Intelligent alerts | ✓ | ✗ |

| Personalized goals | ✓ | ✗ |

| RESP gifting | ✓ | ✗ |

| Online withdrawals | ✓ | ✗ |

| Offers from our partners | ✓ | ✗ |

| 4.5+ stars on Google | ✓ | ✗ |

Let’s help you transfer an account

*Terms and conditions apply, please click here to learn more.

Embark RESP Plans are sold by prospectus. For full plan details, please click here.

1 Big 5 Canadian Banks: BMO, TD, RBC, Scotiabank and CIBC.

2 Based on estimated in-branch RESP Onboarding, including completion of new account opening and RESP forms.

3 Average Canadian mutual fund minimum investment. Per 2024 Series A Fund Facts: BMO Targeted Education 2040 Portfolio; BMO Select Trust Conservative.

4 Average per 2024 Series A Fund Facts: BMO Targeted Education 2040 Portfolio; BMO Select Trust Conservative Portfolio; RBC Targeted Education Fund 2040; RBC Select Choices Conservative Portfolio; Scotia Selected Balanced Income Portfolio; Scotia Partners Balanced Income; TD Comfort Balanced Growth Portfolio

5 Embark Student plan when compared with plan at 2.10% MER for 18 years based on $50 biweekly contribution for 18 years at 5% return.