Limited time offer:

Refer a friend and

get $400.

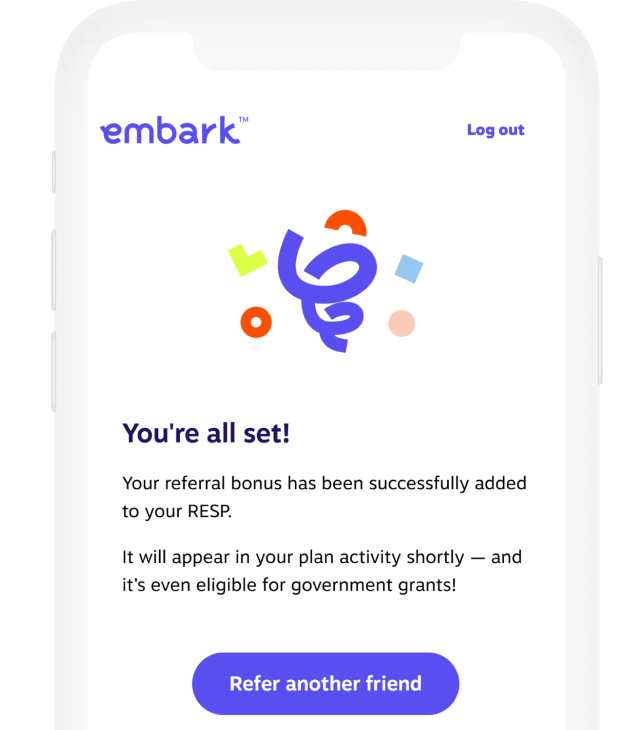

You get $400 for every friend you refer. Your friend gets $250. Conditions apply. Offer ends Nov 20, 2025.1

It’s a great way to grow your RESP, while we take care of the rest.

Leverage your community to save for education with Embark’s market leading refer-a-friend program

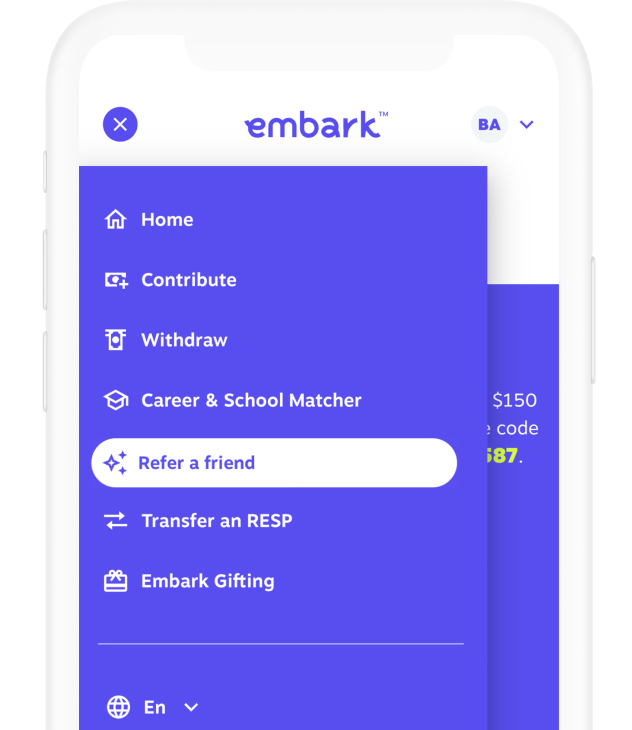

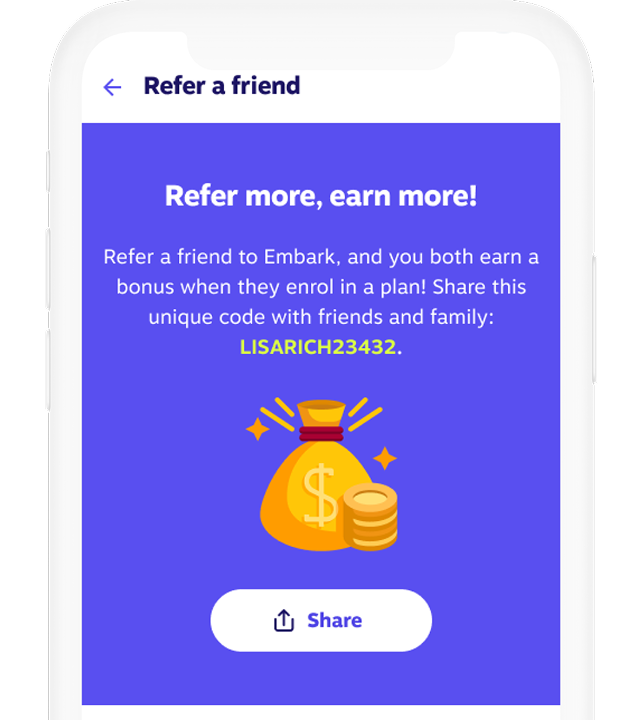

Find your referral link

Share your link or code

Get rewarded together

Fun fact! The average Embark referrer made $356 in 2025.6

How to explain Embark, fast (step 1–5)

1. Show how Embark handles the grants

Government grants can boost your savings. When you sign up, the Embark RESP application automatically includes your grant application.8

2. Explain how easy it is to join

It takes about 8 minutes to open an RESP with Embark. Start with one child and add more later. Not ready today? Save and finish anytime.

3. See how your savings add up

Tell your friend: saving even $5 per week could add up to a full year of tuition.2 Around 60% of Canadians save for tuition first and contribute an average of $100 a month.7

4. Offer help if needed

If your friend isn’t sure, they can connect with an Embark specialist. Our support team is always ready to answer questions.

5. Share useful links

Tips for a greater impact

Where you can do it

How to start referring

Your money is in good hands

Bank-level security

Partnered with top banks

Securely move money

Top choice of over

1 million Canadians

For 60 years, we’ve helped fund post-secondary education for students. Unlike traditional banks, we’re owned by a not-for-profit foundation that puts Canadian families first—reinvesting profits into scholarships to help even more students succeed.

- Managing $6.5 billion in assets

- 60 years of education savings expertise

- 60,000+ students supported every year