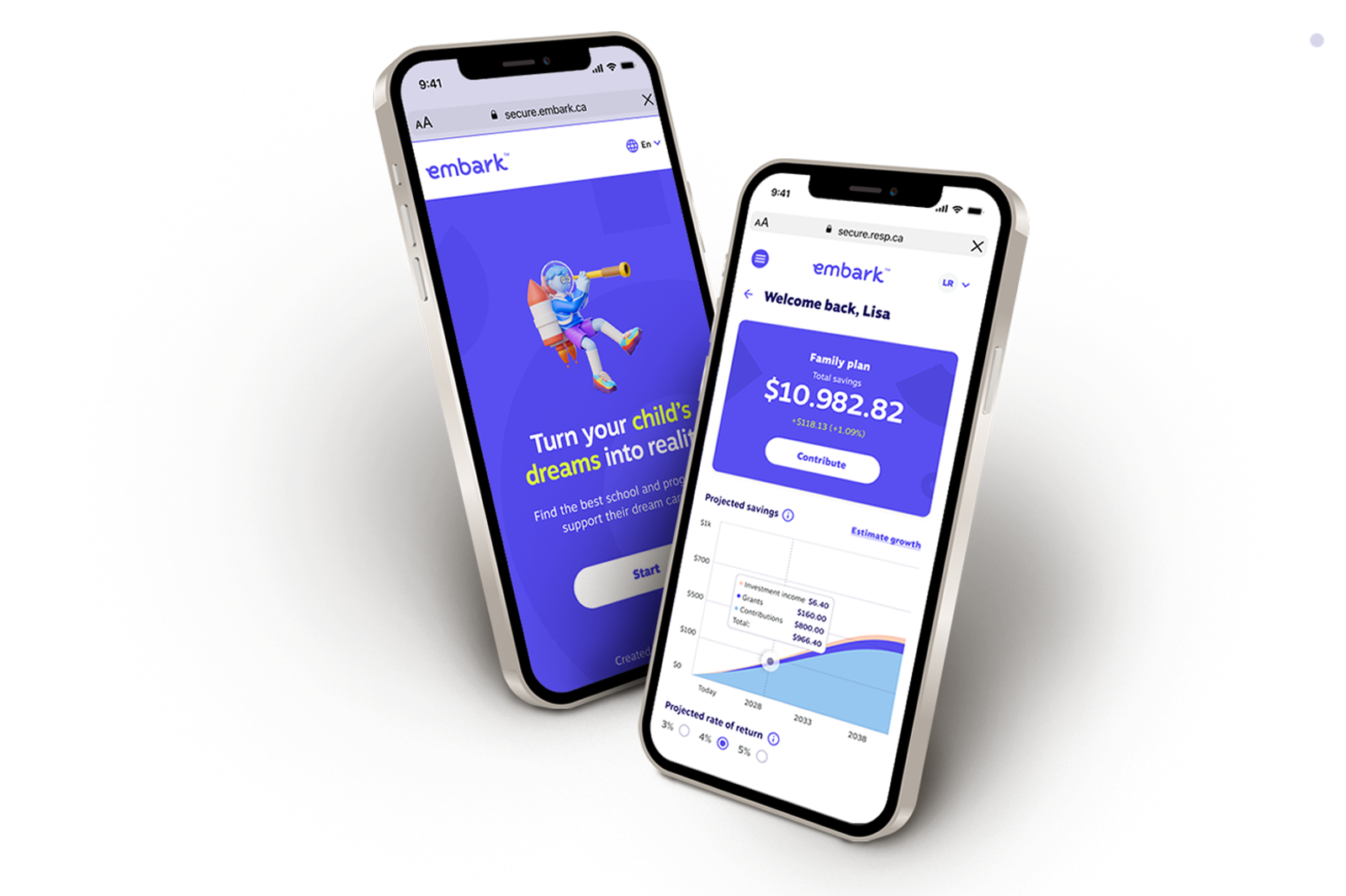

Activate your online account

Transferred to an Embark Plan? Activate your online account today to manage, track and get more from your education savings in no time.

How to activate your Embark account

Helpful answers that save time

You should be able to activate your account in less than 10-minutes.

Activating your account, you’ll get access to all of the Embark Student Plan’s tools to help you track, manage and use your savings plan anytime, anywhere.

You’ll need your social insurance number and a piece of government-issued photo identification.

Yes, in order for each of you to access and manage your plan, you both will need to activate your account separately.

No, once you’ve activated your account, all of your plans should populate inside of it.

Yes, in order to withdraw funds, we ask that you verify your banking information to ensure it’s correct.

Rather than providing Embark with a blank cheque or telling us your banking information, Embark leverages Flinks and Plaid platforms to let you connect directly to your bank account through your online banking. Embark never sees your login information and your bank account is saved directly into your account, rather than shared with a person.

This process also protects you against fraud and payment errors due to manual entry of banking information. Plaid and Flinks validate that you are the owner of the account, but you never have to give your banking details over the phone, email or on paper, which may have security risks.

Both Plaid and Flinks make it easy to securely connect your financial accounts to Embark using their application programming interface (API) technology.

- Embark connects you to Plaid/ Flinks who then use their technology to connect to your chosen bank/ financial institution via online banking.

- Select your bank/ financial institution.

- You will be asked to enter your Access Card/ Login and online banking password. Embark cannot see any of your login details as it happens in the Plaid/ Flinks systems.

- If you have set up 2-Factor authentication with your bank, you may be sent an email or SMS with a code to verify it’s you – this comes from the bank.

- Once you’re in your online banking, you will see your available accounts (This may take 3-5 minutes to connect).

- Select the account you’d like to link to your Embark account, which can then be used for contributions and withdrawals.

- Only your bank account information is provided to Embark – you remain in control of your data.

- Once this is complete, the connection to the bank is terminated.

- Flinks and Plaid are leaders in the Open Banking in Canada and have data access agreements with every bank they can connect to, including all of the big Canadian financial institutions and credit unions.

- Both Flinks and Plaid have comprehensive, security measures and processes in place to help safeguard clients’ sensitive financial data.

- Flinks and Plaid are certified in internationally recognized security standards.

- Flinks is certified in SOC 2 Type I certification.

- Plaid is certified in ISO 27001, ISO27701, SSAE18 SOC 2.

- Plaid is a leading global financial technology firm focused on enabling secure access to financial data.

- Plaid makes it easy to securely connect your financial accounts to the apps and services you use through application programming interface (API) technology. Once connected, Plaid works to verify ownership of your account and transfer the data you’ve permissioned from your financial institution to your app in a way that’s safe and secure. Plaid helps establish this connection while you remain in control of your data.

- Plaid connects to more than 12,000 financial institutions across the US, Canada, and Europe, including all of the major Canadian banks (RBC, CIBC, TD, BMO, Scotiabank, Desjardins, and more) and credit unions, and global giants like Bank of America, US Bank, Wells Fargo, Santander.

- Flinks is a financial technology firm owned by National Bank, Canada’s 6th largest Bank.

- Flinks connects to all of the major Canadian financial institutions (RBC, CIBC, TD, BMO, Scotiabank, Desjardins, National Bank and more) and credit unions. Flinks has the largest available OAuth direct API network and covers 15,000+ financial institutions in the US and Canada.

We use both services to ensure that you are able to connect in case the systems are down.

Sometimes there are errors on the bank side. Either try again later or choose another bank.

This is the bank telling us that you’ve made a mistake entering your details. Either try again, or if you have forgotten your online banking credentials, contact your bank to reset them and try again once they are updated.

In the case where your bank isn’t supported, please contact us.